Precious metals like gold and silver are resistant to inflation because their value is derived differently from paper money or fiat currency. At current low prices and increasing demand for silver today, this precious metal offers a great way to hedge against inflation and hyperinflation.

DISCLOSURE: Some of the links below are affiliate links that provide the author with a small commission to help keep this website up and running. When you purchase through these links, it will be at no additional cost to you. These links point to the very same sources the author had purchased from as well.

If you have been following the silver market lately, you may have noticed that many precious metal dealers and mints around the world have been out of stock in silver bullion for a while now. There has been a shortage in supply of mined silver as silver mines around the world are being shut down due to the coronavirus outbreak.

Why Invest in Silver?

The spot price of silver has fallen to its lowest in 10 years just over a week ago on 18th March 2020, at the price of US$11.74 an ounce. With inflation rising to a peak and a global financial crisis in sight, precious metals could be an ideal commodity to use as a store of value and safe-haven asset.

Given the current low price of silver, this is an opportunity for both new and experienced investors to take advantage of.

Precious metals behave a little like insurance during financial crises. As little as 5% of your portfolio invested in silver could do very well when times go bad. For one, it helps me sleep better at night, knowing that a portion of my assets is in physical silver. Not stocks, not mutual funds, or any of the other financial instruments revolving around currencies.

What about gold? Gold remains one of the best commodities as a safe-haven asset. However, its relatively much higher price could be a barrier to entry for those considering starting out in precious metals at today’s rates.

The current gold-to-silver ratio of around 110:1 indicates that silver is undervalued. This also suggests there is plenty of room for silver to catch up to, and as history has shown, with such spike in the ratio, it is often followed by a retracement to a more average gap between these two precious metals. A spike in silver prices relative to gold’s price movement would make this happen.

Silver is also an industrial metal with wide-ranging applications and will always be in demand. In fact, this demand is continuously rising, as silver is used in everything from smartphones and consumer electronics to solar panels and antibacterial garments.

How to Invest in Silver?

For those who are new to silver and are considering this precious metal as an investment or portfolio insurance, the following serves as a guide to steer you in the right direction and help you avoid the common pitfalls.

1

Buy physical silver

There are a few ways one can invest in silver – there is the physical silver bullion, exchange-traded funds (ETFs) backed by the physical metal, mutual funds that include silver mine stocks, and silver-backed cryptocurrencies, amongst others.

Personally, my advice would be to consider buying only physical silver. This includes coins and bars in their various forms.

ETFs and other paper forms representing silver and other precious metals expose the investor to many disadvantages and risks. New investors (even smart ones) sometimes make the mistake of assuming that holding ETF shares that track the price of silver is equivalent to actually owning the precious metal itself. This is simply not true.

If one goes through the fine print carefully enough, one would probably come across a few clauses that free the fund of any responsibility in certain situations. This poses a huge counterparty risk to the ETF holder.

2

Investor or collector?

At the start of this venture, you are going to need to decide if you are an investor or a collector, because certain silver items are collectibles that cater to the collector’s market.

One can argue that collectors are not investors as collectors usually pay a high premium over the spot price of silver, which goes against the cardinal rule of investing: buy at the lowest price possible.

However, some (myself included) appreciate the collectible element in silver and treat this trade as both a hobby and investment. Just as how some people invest in sports and baseball cards.

The difference with silver collectibles is its base is still a precious metal. And as mentioned earlier, there is always a great demand for this industrial metal for use in everyday applications.

Just be aware that collectibles often include high premiums for their condition, rarity and numismatic value that would sometimes make them poor investment choices. If you have to include collectibles and commemorative memorabilia, make sure you’re not overpaying in premiums and that they constitute a smaller portion of your overall silver portfolio.

In my opinion, the bulk of your silver investments should be in bullion.

3

Understand the terminology of the trade

If you’ve just started exploring silver, you may come across a few terms that you have not encountered before. I will list a few below to get you started:

- Argentum: The Latin word for silver, abbreviated as Ag on the periodic table of elements.

- Assay: A test to determine the quality and purity of a silver product. When a silver bar ships with an assay, it is a guarantee from the assayer that the item contains the described mass and purity of silver.

- Bullion: Any piece of highly concentrated silver at high purity (usually 99.9%) minted or cast into coins or bars for the purpose of physical precious metal investment.

- Brilliant Uncirculated: Often denoted by the abbreviation BU, this means a coin is in pristine and immaculate condition and has never been in circulation or use.

- Circulated: Coins which have been released into circulation for use by the public and are generally in varying degrees of worn condition.

- Constitutional/Junk Silver: Pre-1965 half dollars, quarters and dimes and other similar coins which contain up to 90% of silver.

- German Silver: German silver is NOT silver, and is actually a white alloy of nickel, zinc and copper. Some sellers may intentionally try to pass this off as an exotic form of silver, so beware of fake silver sold as such.

- Gold-Silver Ratio: The amount of silver one can purchase with one ounce of gold based on the current spot prices of both metals. E.g. if the current prices per oz. of silver and gold are $20 and $1,000 respectively, the Gold-Silver Ratio or GSR is expressed as 1:50.

- Legal Tender: Face value of coins that can be used as national currency, usually much lower than the value of the metal itself and stated on the face of the coin. A 1 oz t silver coin may show a value of 1 dollar or 5 dollars.

- Mint: The refining company which fabricates silver (and gold) bars, coins or rounds. E.g. The Royal Canadian Mint, The Royal Mint, The Perth Mint etc.

- Mint State: A condition given to coins at a certain level of immaculacy, graded between 60 and 70 on the Sheldon Grading Scale as determined by a grading company such as PCGS and NGC. The Sheldon Grading Scale developed by Dr William Sheldon in 1948 grades a coin from lowest at PO-1 (poor) to the highest at MS-70 (mint state) depending on its condition.

- Proof: A coin that has been struck with greater pressure using special dies during minting to create a highly polished and pristine appearance. Usually collectibles that are traded at much higher premiums than the standard coin of the same type.

- Purity: The content of silver in a coin or bar. A .999 and .9999 indicate a 99.9% and 99.99% purity.

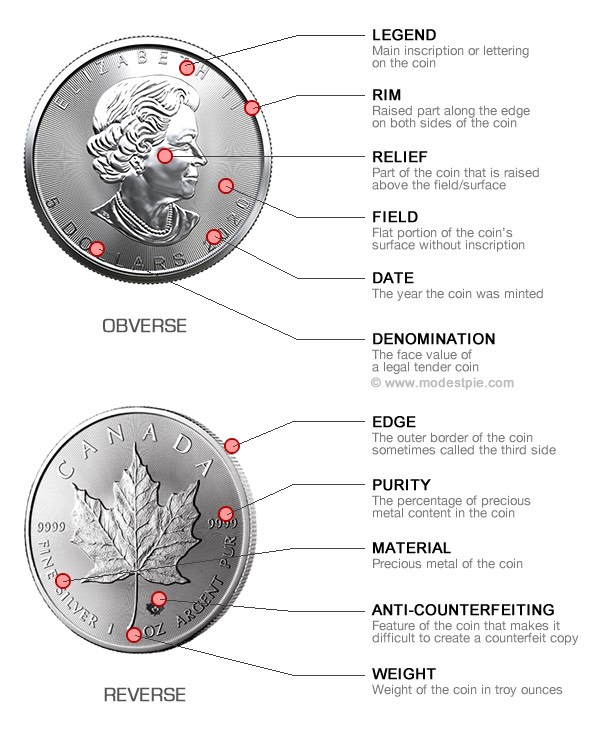

- Obverse: The front (head) side of a coin, usually bearing the head or face of an important person.

- Reverse: The rear (tail) side of a coin, usually with a distinguishing icon or design that indicates where the coin was minted, as well as other details such as the coin’s purity and weight.

- Round: A term used to differentiate and describe silver in coin form that is not formally legal tender issued by a sovereign government mint.

- Silver Stacking: The act of collecting and accumulating small pieces of silver coins, bars, rounds and hand-poured silver items.

- Spot Price: The live, up-to-date price of silver (or gold), determined by the latest trades on the futures market as well as over-the-counter (OTC) markets.

N.B. Some of the terms above will apply more to the collector than the regular investor.

4

Get a grasp of mass and the math!

Some of us are more familiar with the metric system over the imperial units of measure. I was brought up to measure a feel for things around me in grams and kilograms, and sometimes tonnes.

When you start looking at silver, you will need to get used to the imperial system. Inadvertently, I now have troy ounces at my fingertips, including its conversion to the metric system.

Silver bullion is often sold by the troy ounce (oz.t) although sometimes you will also see silver bars marked in grams and kilograms. However, spot prices are usually quoted in dollars per ounce (in this case, troy ounces), so it’s always good to revert back to the troy ounce no matter what unit of measure you use. That way, you get an instant feel for whether a coin or bar is overpriced or if it carries a high premium.

And speaking of ounces, there is a difference between an ounce (oz) and a troy ounces (oz.t). An ounce is 28.350 g, while a troy ounce is 31.103 g. There is about 2.75 g between the two, which may not seem like a lot but if you’re buying 10 oz of silver, the difference is almost an extra ounce.

Beware of sellers who may, knowingly or unknowingly, try and sell you silver bullion in ounces. With less silver in an ounce than a troy ounce, the item may be priced a little cheaper and may seem like a good deal when it really isn’t. Worse if it was sold at market rate and you’re getting 10% less silver.

Always remember that silver (and other precious metals) are sold by the troy ounce.

Also, plant a feel in your system that 300 g is almost but not exactly 10 oz.t (311.03 g). In other words, don’t pay for a 300 g silver bar by comparing it to the price of a 10 oz.t bar.

For brevity, the term ounce is usually taken to mean troy ounce in this trade, so don’t get too tangled up in this.

5

Know the different types of silver

As a silver investor, you should always buy pure silver at the purity of 99.9%. Some mints pass purified silver through an extra round using electrolysis to bring it to 99.99% purity, but for the investor, either purity is fine silver.

Other than fine silver at 99.9% purity (hence 999 silver), there are also items made of sterling silver with 92.5% of silver content (hence 925 silver), and coin silver and constitutional coins with silver content ranging from 50% to 90%.

American coins such as the Roosevelt and Mercury Dimes, Washington Quarters, and Walking Liberty Franklin and Kennedy Half-Dollars that were minted in 1964 and before had 90% silver.

You may consider investing in this type of silver, but just be aware that 1 troy ounce of such items will consist of less weight in silver.

If you are just entering into silver as an investment, consider acquiring only fine silver at 99.9% purity at the lowest price possible.

6

Be aware of premiums

The end product that is available and sold to you has usually undergone a number of processes and hands before it reaches you. After leaving the silver mine, the minting process, stamp designs, anti-counterfeiting features and other transition work involved will incur a premium on that product, be it a coin or a bar. And then there are the usual profit margins on top of that.

Some physical silver items have antique or historical value. Other coins with numismatic value could have been sent for grading, and these would have added additional premiums reflected in the final price of the item.

Be aware of these premium mark-ups on top of the spot price of silver, to know how much extra you are paying for that silver product. If you’re investing in silver purely for its metal, select the ones with the lowest premiums.

7

Choose your denominations

Minted silver coins are often sold in the usual denominations of 0.5, 1, 2, 5, and 10 troy ounces. Silver bars come in 1, 5, 10 and up to 100 troy ounces. You may also find in-betweens and odd denominations in hand-poured silver.

Silver bullion (bars and coins) are also sold in grams and kilograms.

The important consideration with denominations is choosing which ones to buy.

Premiums on larger silver bullions work out to be much lower when calculated on a per troy ounce basis. For example, it would cost less dollars per troy ounce for a 10 oz.t silver bar, than for 10 pieces of 1 oz.t bar.

Both denominations have their purposes. If you want to sell a troy ounce of silver in the future, having only a single 10 oz.t silver bar may prove to be difficult. On the other hand, you are not getting the best value for your money by buying 10 pieces of 1 oz.t silver bars.

It would be a good idea to buy both denominations for both situations, and maybe even the denominations in between, depending on how you plan to spend, keep and sell your silver.

If you’re starting with a larger budget, you may consider buying the larger denominations to get the best price at the lowest premium possible.

If you’re planning to set aside a portion of your salary to acquire silver bullion on a monthly basis and don’t have a big budget to begin with, you may consider buying them at 1 or 2 troy ounces at a time.

8

Learn all about YOUR silver

Whether you’re choosing an American Silver Eagle, a Canadian Silver Maple Leaf, a Krugerrand, or an Austrian Philharmonic, it can be fun to learn about the coin and mint that you’re buying from. Discover about their history and how some mints introduce anti-counterfeiting features into their coins and bars.

Some coins are more prone to milk spots than others, if that is a concern.

Some coins have better demand on the secondary market than others.

Some mints buy their blanks from other mints to produce the silver coins that end up in your hands.

Learning about the coins (and bars) you are going to acquire this way makes investing and stacking silver a lot more interesting and exciting.

Investing in silver doesn’t have to be boring.

To get you started, here are a few PDF brochures and reading material for some of the coins above:

9

Find your dealers and mint

There will usually be at least one or a few precious metal dealers in your city. Visit their websites and make a comparison of their silver prices. Look at the different silver products and denominations that they carry. Also, check how long they have been in business, and their reputation and trust ratings online before ordering.

If you happen to live in a city where there isn’t any shop or dealer, you may consider shopping online. Some dealers and private individuals operate their silver trading business online without a brick-and-mortar presence.

Even so, the same rules above apply, and you can usually tell how legitimate and trustworthy a seller is by how long he has been in business and the reviews left behind by previous customers.

You can check a dealer’s accreditation, rating, and customer reviews and complaints at the Better Business Bureau’s website or google them up.

When silver is out of stock at most mints and dealership, buying silver bullion from trusted sellers on eBay and Amazon can be a viable option. Before buying, always check the seller’s profile – see how long he has been a registered user on the platform and how long he has been selling, and look at the trust rating and check for negative feedback. Avoid sellers that only have one or two silver bullion to sell amongst 1,001 non-related items.

10

Store and handle your silver properly

So, now that you’ve purchased some silver coins and bars, how do you store them properly?

Unlike gold, silver has a tendency to tarnishlose or cause to lose lustre especially as a result of exposure to air or moisture if they have not been stored or handled carefully.

Silver becomes tarnished as a result of a natural reaction to hydrogen sulphide in the air. Yes, hydrogen sulphide is a component of flatulence that gives it that rotten egg scent. Well, even if smelling fart is beneficial in preventing heart disease and kidney failure as some study seems to suggest, we know it is bad for your silver.

Hydrogen sulphide (H2S) is found in trace amounts in food items such as eggs and onions, and in materials such as wool, paint, rubber and asphalt paving. The gaseous form of hydrogen sulphide is also released during bacterial breakdown of organic matter, and produced during the decomposition of human and animal waste.

In summary, keeping your silver away from rubber bands, paints and decomposing organic matter (as well as fart) prevents it from tarnishing prematurely. But, that is not enough.

Silver will also quickly tarnish when exposed to heat and moisture. Hence, to keep your silver from tarnishing, keep in mind the following practice:

- Keep silver in plastic tubes designed for stacks of coins. See photo below.

- Keep silver in air-tight zip-lock bags.

- Keep silver in plastic containers or capsules.

- Keep silver in PVC-free vinyl pockets. PVC is ok for short-term storage or for transits.

- Wear cotton gloves when handling silver to avoid transferring natural oils from your hand to the silver.

- Without gloves, handle your coins or bars by holding its edge and never on its faces.

Compulsory: Store the above in a cool dry area away from direct sunlight.

Optional: Add a small pack of silica gel in each of the above for moisture absorption.

For small quantities of silver, one may opt to store physical silver in safe deposit boxes at a bank. However, this is not recommended, as banks may be ordered to be locked down and access to funds halted during a serious financial crisis, and this goes against the reason of investing silver in the first place, i.e. personal wealth protection.

Where possible, you should store your own silver where it is in your own control, preferably in a safe with multiple layers of protection from visibility or access.

For bulk purchases or larger quantities of silver, one may opt to store them in non-bank vaults offered by precious metal depositories or storage facilities locally or around the world. Some dealers also offer such storage facility.

Needless to say, facilities should be selected based on the stability of the government of the country where that facility is located. This is usually described by the country’s economic stability, monetary policies, and corruption index, amongst other factors.

One of the most stable and safest countries around when it comes to storage of precious metals is Singapore. With vaults located in Singapore and New Zealand, you can find out more about BullionStar at https://www.bullionstar.com/.

I covered briefly above some of the reasons why silver is a good addition to your investment portfolio.

Beyond that, it is a good idea to also learn more about the health of our financial system and of global economies, and why silver and other precious metals could facilitate new transfers of wealth at best, or at the very least serve as good stores of wealth during an inflationary crisis or political upheaval.

Well, hello there. I just had an interesting conversation with my uncle who wishes to get himself several silver coin collections for some reason. By suggesting that storing and handling our silver coin has to be done carefully due to their delicate nature, you’ve managed to capture my interest. Okay then, I’m gonna advise him to pay close attention to this particular matter before purchasing any material later on.